(Friday’s Populist Capitalist Blog Post)

(Friday’s Populist Capitalist Blog Post)

Markets, businesses, and relationships all flourish when trust exists. If I have to spend all my time guarding my back, protecting myself against being taken advantage of, then I’ve wasted a lot of time that I could have spent doing real work, being productive, making the world a better place.

Trust is important. Trust makes things move faster, go more smoothly. But trust must be earned by trustworthy behavior, by agreement on and adherence to high standards of conduct. (“Speed of Trust,” by Stephen M. Covey, is an excellent book on the importance of trust in conducting business.)

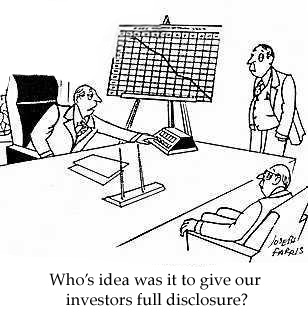

Unfortunately, such trustworthy behavior has been a bit lacking in the financial arena of late. Stockbrokers have generally been exempt* from the higher standards currently imposed upon Registered Investment Advisors. The Feds are attempting to impose a higher standard of fiduciary duty on brokers; Wall Street has agreed in principal, but the fear is that the concept of fiduciary duty could easily be gutted by a too loose definition.

Three proposed ways in which brokers’ duty to clients may be strengthened:

– Registered Investment Advisors must disclose how much they are being paid to sell one fund over another and they must offer investments in the clients’ best interest. Brokers merely have to offer “suitable” investments and have no duty to declare their compensation structure or if or how much they stand to gain personally.

– Registered Investment Advisors must disclose any past disciplinary actions; brokers have no duty to reveal past transgressions or other background.

– Registered Investment Advisors are forbidden to use testimonials from clients, sports personages, or celebrities. Brokers are not. The primarily “feel good” content of most testimonials is considered more likely to mislead than to inform and they lack relevancy to the hard statistical data required for intelligent investing. (Remember the standard small print disclaimer on most weigh loss testimonials: “Results not typical, outcomes may vary”?) Plus many giving testimonials are compensated in one form or another, rendering their validity of even greater doubt.

Unfortunately, even the best disclosure can be buried in a mountain of other forms; we’ve all been overwhelmed by long, fine print notices about this or that from our credit card companies. It is rare that legislation is drafted well enough to require the most important information be 1. up front, 2. rendered the same type size as in the largest type used elsewhere in the document, and 3. repeated in bold type above any required signature.

Of course, there is the European method: instead of specifying in great detail how disclosure should be done, the Europeans tend to simply give a principle: disclosure shall be sufficient for an average person to understand and comprehend. Perhaps a combination: specified minimums but still maintain overall requirement of adherence to full and adequate disclosure of material information. The principle component keeps the lawyers and marketing folk from scouring the legislation for myriad ways to technically comply with the letter of the law while totally gutting the spirit.

Free markets can create tremendous value, but markets also can be rigged and manipulated. To create the maximum long-term prosperity for all, markets must be kept free, open, and fair without being strangled by red tape. It is a balancing act that requires intelligence and an understanding of both human nature and market forces. It is up to us, the electorate, to vote for quality individuals who can maintain this balance. And that we not fall into the trap of simply voting for those who promise us “bread and circuses” ad infinitum.

*Stockbrokers have been held to a lower standard of care for the offering of investment advice as long as “performance of such services is solely incidental to the conduct of his (sic) business as a broker or dealer and who receives no special compensation therefore.”