Subscribe to NSCBlog

Are the Emotions You Are Creating Helping or Hindering You?

The formation of emotions is complex and almost always occurs beneath the level of our conscious awareness and there is also usually a delay between…

April 25, 2024

“Tell me, what is it you plan to do with your one wild and precious life?”

The quote is by the poet Mary Oliver (1935-2019, Pulitzer Prize winner) and the elegant beauty of it always spoke volumes to me. I live…

April 23, 2024

Your Actions Tell the True Story

I was struggling with a performance situation once and a therapist told me “Listen to the Behavior.” That was a powerful insight for me in…

April 18, 2024

Who Told You it Would Be Easy?

And if someone ever did, why would you believe them? If it were easy, everyone would do it, so what’s the point? Where is the…

April 16, 2024

Envy….or Inspiration?

When you behold the success of others; what first comes to mind? Are you truly happy for them? Or is there a twinge of resentment?…

April 11, 2024

Practice is a Skill

Or more fully stated: ‘effective practice is a learnable skillset’. It may sound like heresy, but not all practice is good practice or at least…

April 9, 2024

Will is a Skill

For many of us and for much of our lives we have absorbed the concept that willpower, along with its close cousin, self-discipline, is an…

April 4, 2024

Baker’s Dozen

Recently, I was asked: “What is the most valuable piece of advice you would give to anyone new at TCC who is looking to grow…

April 2, 2024

Words That Give Away Your Power

Phrases like “You made me…” or “I have to…” or “I had no choice” give away your power. You always have choices; the choices may…

March 28, 2024

Life is a Roll Call

Roll Call: The reading aloud of a list of names, and subsequent responses, to determine who is present or absent. Every day, the sun rises,…

March 26, 2024

Only the Best Obsess

Obsession has gotten a bad name in some circles but directed and managed, it is the gift of the gods. I think of obsession (and…

March 21, 2024

One-Time Phenomenon

You are a unique combination of DNA that has never happened before and will never happen again. Throw in that every person’s environment is also…

March 19, 2024

Fan the Spark, Guard the Flame

Within each of us lies both goodness and talent of some form, the ability to improve the world and to sculpt ourselves into our best…

March 14, 2024

Our Daily Duty

Every day life begins anew and with it an opportunity for new (more informed?) choices, new (wiser?) decisions, new (better?) paths. Will you go to…

March 12, 2024

Problems are Pathways

Life is a school, and problems are the homework. The penalty for not doing your homework is that the lessons repeat until you do. Everyone…

March 7, 2024

Do Your Job

Whatever your trade, your vocation, whatever your life purpose; make it your mission, make it your calling. In other words, give it your best. For…

March 5, 2024

Elevate Your Identity

Your identity, your self-concept, is who you think you are, the story you tell yourself about yourself as well as the standards you hold yourself…

February 29, 2024

Your Emotions are a Signal… Not a Command

Emotions are just a message about how we are interpreting events and situations in the world around us. They flow out of our expectations and world…

February 27, 2024

Happiness is Not the Goal… Neither is Eliminating Unhappiness!

Happiness is Not the Goal: Happiness can be very elusive when directly pursued. Rather, happiness is best achieved as a byproduct of living a life…

February 22, 2024

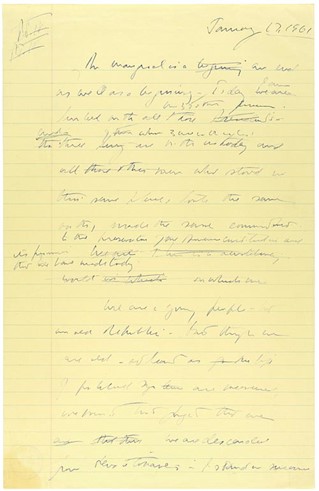

Ask What You Can Do

During his inaugural speech on January 20, 1961, John F. Kennedy famously said: “Ask not what your country can do for you- ask what you…

February 20, 2024

Run Straight at the Pain and You will Develop Superpowers

I’m not talking about physical pain so much as I am about emotional/social pain i.e. the ‘pain’ of self-discipline, the ‘pain’ of social rejection, the…

February 15, 2024

Build the Chain

We are so much the product of our habits. So how to form habits that take us where we want to go? And break the…

February 13, 2024

You Are The Project

You are the most important project you will work on your entire life. Think of yourself as a work in progress; approach your life as…

February 8, 2024

Plan Your Future in Advance

Hey, the future is going to come and if you want a better future, you’d best start doing something about it today. The most basic…

February 6, 2024

Could it be Me?

Sometimes we don’t make the progress we would like in life or maybe not as fast as we would like. As we look around for…

February 1, 2024

You are the Creator

I am continually amazed at the extent to which our belief systems create our life. Whether we realize it or not, at some level, we…

January 30, 2024